Pool

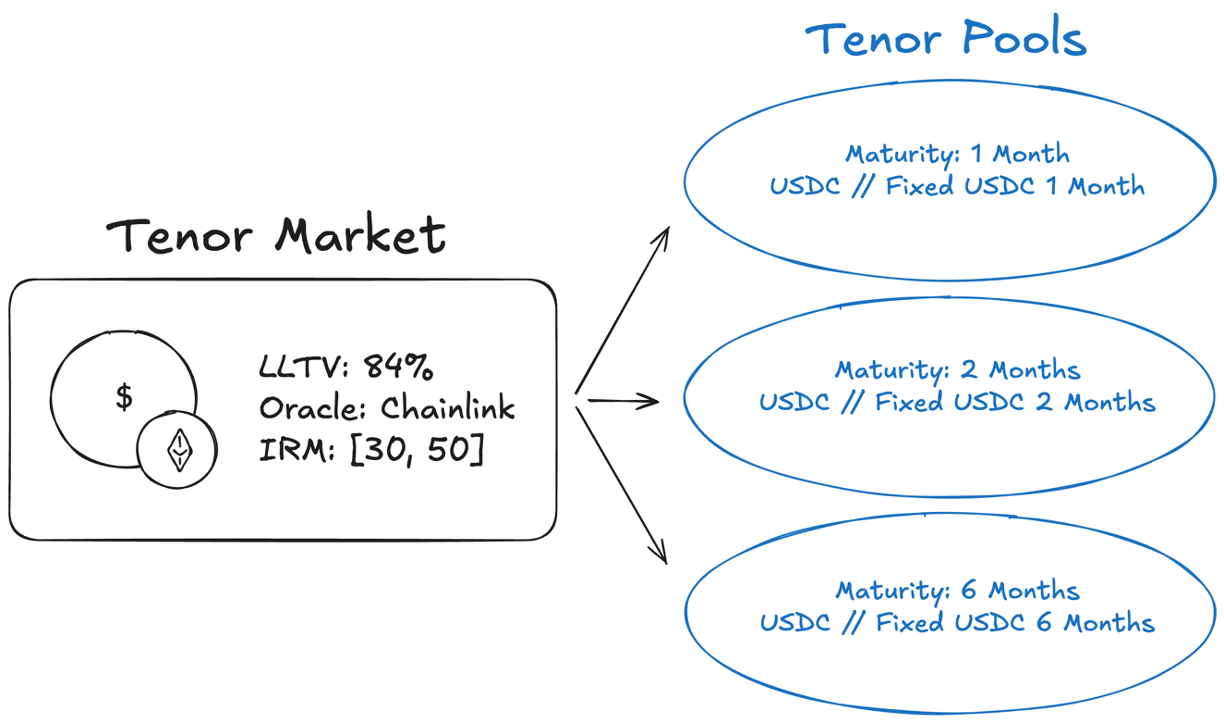

A Tenor Pool is the component of the protocol that enables the swapping of loan assets (e.g., USDC) between lenders and borrowers at a fixed interest rate for a specific maturity. As presented below, each pool is associated to one Tenor Market and has a unique maturity date. Tenor Markets can have multiple pools of different maturities.

A Tenor Market with multiple pools of different maturities leads to the creation of a term structure/yield curve on top of the reference Morpho variable rate market. Learn how to create a Tenor Pool in the Market Curation section.

Interest Rate AMM

Swapping of Fixed Tokens and Loan Tokens in a Tenor Pool is done using an Interest Rate Automated Market Maker (IR AMM). When a user swaps, the IR AMM finds the nearest tick (liquidity or limit) with a positive balance of the desired token. Swapping in the pool can only be done before the pool's maturity.

Pool Tokens

Tenor Pools contain two types of tokens:

After swapping, borrowers receive Loan Tokens allowing them to redeem the loan asset and lenders receive Fixed Tokens allowing them to claim a known amount of the loan asset at maturity.

Pool Parameters

Deploying a pool for a Tenor Market only requires one input:

- Pool Maturity Date